It was perhaps no surprise to hear today’s announcement that the Bank of England will be holding interest rates at 0.75%. With the Brexit deadline looming fast and still no certainty as to the UK’s position come 29th March, the Monetary Policy Committee (MPC) could really do little else than adopt a cautious approach.

Perhaps the biggest question now is; deal or no deal – what will happen to interest rates post Brexit? Governor Mark Carney’s so-called ‘Doomsday scenario’ caused controversy when it stated that inflation rates could rise as high as 5.5% if a plunging pound sent inflation soaring[i]. Other experts claimed that interest rates might – in fact – sink below zero for the first time[ii].

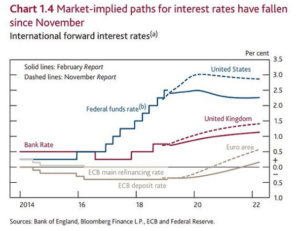

It’s now a decade since the MPC slashed rates to 0.5% in the wake of the financial crisis, meaning a whole generation have never seen interest rates hit 1%. They are still forecast to rise over 1% but – in line with the US and Eurozone – this is now predicted at a much slower rate than outlined in November 2018.

All eyes will be on 29th March and the impact of the Brexit deal – or no deal – on the pound and inflation. Interesting and unprecedented times are sure to be ahead and if you have any queries, concerns or thoughts on how Brexit might affect your situation, don’t hesitate to get in touch with our team of expert advisers, who are always on hand to help.

[i] https://www.itv.com/news/2019-02-25/negative-rates-could-be-on-the-cards-in-no-deal-brexit-chaos-blanchflower/

[ii] https://www.thisismoney.co.uk/money/news/article-6740947/Negative-rates-cards-no-deal-Brexit-chaos-Blanchflower.html

Your home may be repossessed if you do not keep up repayments on your mortgage.

You may have to pay an early repayment charge to your existing lender if you remortgage.